About

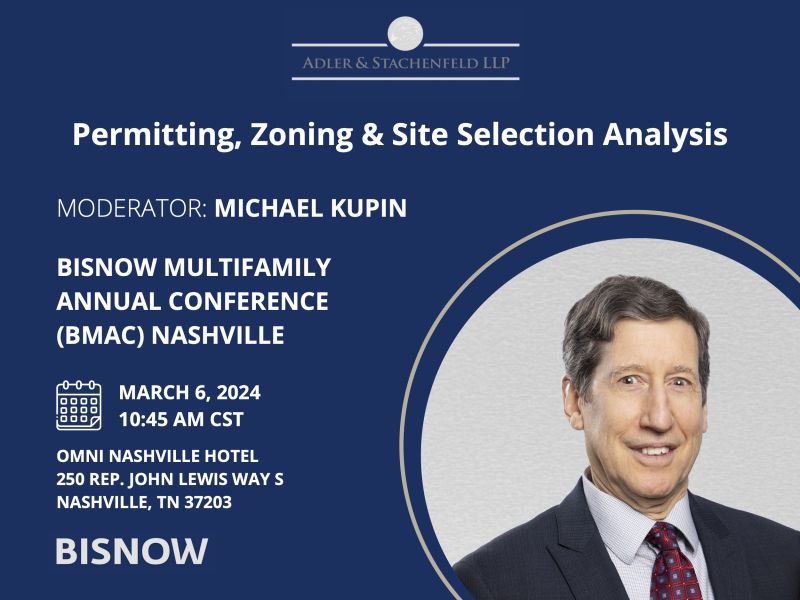

Michael Kupin is a member of Adler & Stachenfeld’s Real Estate Practice and co-chairs the Construction Practice. Mr. Kupin has earned a reputation as an attorney to whom clients turn to for their critical transactions that do not fit neatly within a single practice area; that have an uncommon structure; or that have difficult relationships or stakeholders to manage - their so-called “out-of-the-box” transactions. That experience spans an uncommonly wide range of practice areas, including commercial leasing with a focus on large-block office leases and high-end retail leases; construction, architect, and consulting agreements (owner side); capital markets lending (both lender and borrower side), private equity fund formation, and hotel/resort franchising from an institutional investor perspective.

In recent years, Mr. Kupin has developed two specialized practice niches, one of which is an expertise in construction, architecture, engineering, design, and related consulting agreements. He has a deep understanding of the issues impacting property owners hidden in the regularly used AIA forms. Mr. Kupin has spearheaded engagements where counterparties included some of the larger construction contractors and managers in the country such as Structure-Tone and Turner Construction; major construction consultants such as Zubatkin and Gardiner & Theobold; and world-renown architects such as Robert A.M. Stern. The other niche is representing building owners leasing large blocks of office space to agencies of New York City. He has an expert’s knowledge of the special forms, provisions, hot buttons, and other transactional anomalies that are unique to New York City.

Beyond providing legal counsel, clients value the many strategic business connections that Mr. Kupin regularly makes among clients, prospective clients, and other business relationships of his, all made with the goal of helping each of his clients grow their business.

Prior to joining the Firm, Mr. Kupin practiced law at Paul Hastings, Akin Gump, Brown Raysman, and Rogers & Wells (now Clifford Chance). He is admitted to practice in New York.

Notable Transaction Expertise:

- Represent a lower Manhattan high-rise office building owner in the lease-up of an approximately 850,000 square foot building including ground floor retail space and approximately 500,000 square feet of space in a series of leases to multiple New York City governmental agencies over a three year period of 18 months.

- Represented a nationally recognized top tier law firm leasing 88,000 square feet as one of the first tenants in a newly developed office tower in Hudson Yards.

- Drafted and negotiated construction agreements for ground up residential apartment developments in the Northeast and for high profile commercial office installation in excess of $26,000,000. Developed a construction form for client roll-out as part of growing portfolio of properties to be repurposed as light industrial rental properties.

- Successfully navigated office building owner through COVID related construction delays and cost overruns in $19 million dollar construction project.

- Represented a New York based special situations lender in a $31 million mezzanine loan transaction for the completion of a super-luxury resort in the Dominican Republic.

- Counseled a nationally recognized private equity fund in the acquisition of a stressed urban shopping mall involving purchase of a defaulted loan from a lender in bankruptcy, settlement of ongoing litigation among multiple stakeholders, negotiation of a joint venture with a nationally recognized investment partner, and closing of an institutional financing and a subsequent refinancing.

- Represented a subsidiary of a publicly-traded REIT in negotiations of hotel franchise and related agreements with five internationally known hotel brands as part of two separate acquisitions of portfolios of upscale extended stay hotels and premium branded select service hotels involving in excess of 65 hotel properties nationwide.

- Counseled internationally known luxury fashion retailer for leases in multiple high-profile retail locations.

- Counseled an international investment fund in a joint venture with a prominent Seattle-based developer for an $800 million mixed office/retail/residential project in Bellevue, Washington (also counseled the joint venture in a related $665 million construction loan).

- Represented purchaser in a $1.1 billion two-staged acquisition of the Miami Dolphins football team, Dolphins Stadium and adjacent development properties.

Awards:

Mr. Kupin served as principal legal counsel for ownership in the lease/option transaction that won the prestigious 2018 Ingenious Deal of the Year Award from the Real Estate Board of New York.

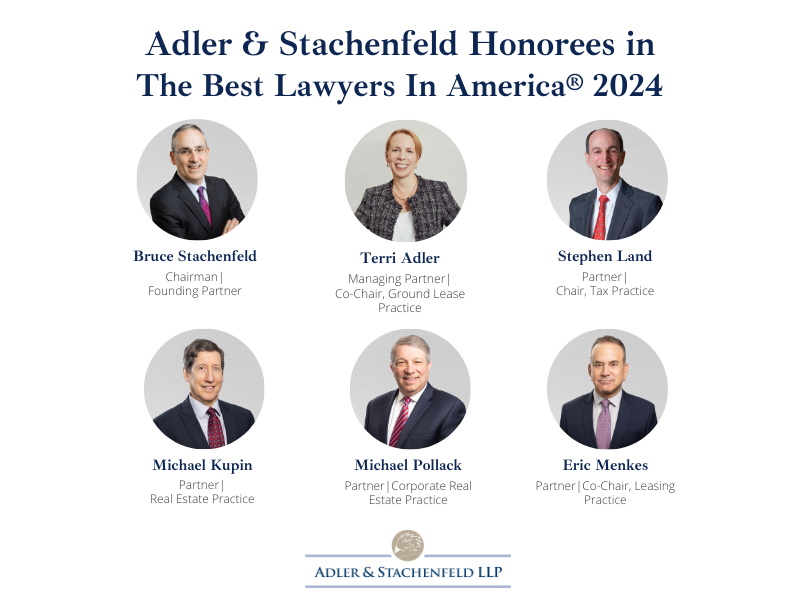

Recognitions:

- Listed, The Best Lawyers in America - Real Estate Law (2020 - 2026 Editions)