Don’t ask me why I was doing this, but I was recently comparing the market capitalization of WeWork to SL Green. WeWork’s is a little over $3B, and SL Green’s a shade under $3B – they are getting close to equal as time goes on.

But the amazing thing is that…..

WeWork has a negative profit margin of 85% (not a typo), is losing over $1B a year, and has about $625M of cash left. Levered free cash flow is negative $895M. Its price-to-book value is seemingly non-existent, as I don’t know if it has any book value at all. Of course, there is no dividend.

Yet SL Green owns 88 buildings with 38M square feet, including over 28M square feet in Manhattan. It has a 45% profit margin, and cash is pouring out of it as levered free cash flow is $416M. And its price to book value is 0.64. It also sports an 8.61% dividend.

But according to the public markets, they are worth the same amount?

By the way, I got all this information from YahooFinance, and cannot independently validate it.

This is kind of nutso to me. Actually, it is beyond nutso. WeWork has never made a nickel – and is losing a fortune – yet it is more valuable than SL Green, which is one of the largest property owners in New York City.

Why is all this happening?

The answer is very simple. Everyone hates office. I mean, EVERYONE HATES OFFICE!!!

There is so much negative buzz about this it has reached a crescendo. A recent article in The Real Deal said that pension funds are “breaking up with office buildings.”

Another article was the quirky article last month from the Columbia University and NYU academics projecting NYC office values would drop 28%, which I poked some fun at in a recent Real Estate Philosopher article, "Office Apocalypse, Really?".

Scarcely an hour goes by where I don’t see an article telling me how much vacant office space there is – or how WFH will destroy office as an asset class – or that (almost half) of all companies want to reduce office space – or a cute human interest story about how Toby Jones likes to work at home as he loves feeding his cat – or how much space KPMG shrunk down when it went to its new office.

Two years ago, retail was loathed as an asset class. Clickbait media stories abounded. I recall one article about a year ago stating that 80,000 stores were destined to close in the next five years. Yikes – sounds terrible. The point I made at the time – although I didn’t write an article on it -- was that it was a silly article if it didn’t consider how many stores were expected to open during that time -- as otherwise, it was just playing around with misleading statistics. Strangely – well, not strangely – only six months later, an article pointed out the exact opposite – even last year – that more stores were opening than closing, and I think that trend is even stronger this year in 2022.

And now the media is doing its thing on office.

Yet Jamie Dimon is quietly telling everyone to come back to the office – I guess he is not really being that quiet, is it if it hits the front page? So are Goldman Sachs, Jefferies Investment Bank, and many other parties.

Talk of a recession is everywhere, and for the first time, employees are starting to realize that those who don’t come back to the office will be the first to be let go when the recession’s teeth bite.

Also, here is a shocker – some youngsters are starting to realize that (i) the chances of a cool career are much lower at home, (ii) going to the office can be a lot of fun, and even inspiring, if you have good colleagues, and (iii) WFH, which is cool at first, can get awfully boring – sort of like a guilty pleasure, i.e., who wants to eat ice cream three meals a day.

Oh, and this is a quirky little anecdote. I was wandering around the mall a few days ago and found a store that sells……dare I say… suits? It was packed, and the guy there said business was off the charts as people plan to return to the office.

And let us think of how much space an office can really shrink. You can't shrink if you let people WFH one day a week. Two days a week, maybe you could a little, but it is pretty tricky – and is it really worth it? My sense is you would have to be three days a week WFH, or less, for WFH to result in significant shrinkage. How many companies will go that far is hard to say, but my sense is not that many. And then how much actual shrinkage comes from eve three days a week? WFH is hard to figure out.

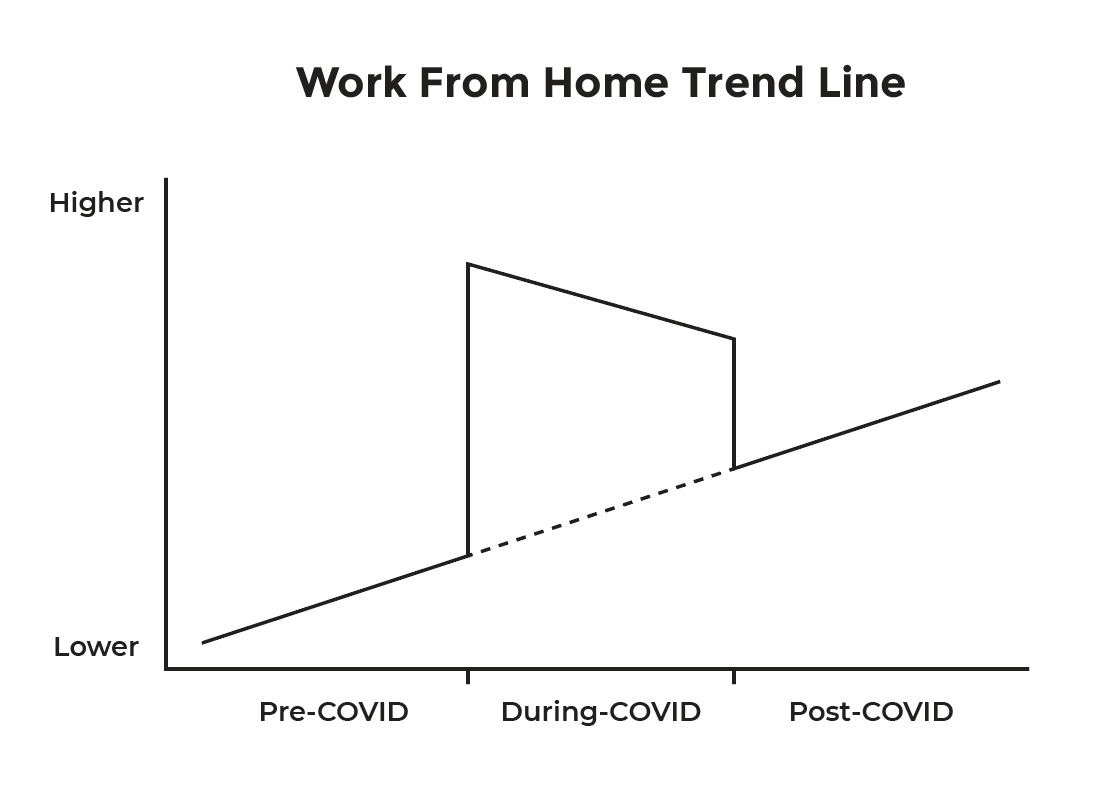

Also, as far as office space shrinking – as I said in my Real Estate Philosopher book, I have the same prediction on office shrinkage versus WFH as I always have had; namely, this trend line:

My analysis is that in the end, companies always want to shrink office space -- of course, they do, but they also need a place for their employees. This push/pull has gone on for years, and I see no particular reason for a major change.

As one thinks about the media’s detestation of office, I recall the famous article in Businessweek in 1979 titled “The Death of Equities.” The article said, “for better or worse… the U.S. economy probably has to regard the death of equities as a near-permanent condition.” Poor Businessweek made the worst prediction maybe ever, as equities returned 18% a year for 20 years!!! Indeed the headline was like ringing the bell at the bottom.

Screaming headlines that say SELL, SELL, SELL are often an incredible buy signal.

Of course, just because many people say sell doesn’t mean one should buy just to be contrarian. I would never advocate that. But I would say that there is a decent chance that right now, the media is amplifying every negative data point on office – just as they did on retail – and hotels too, which all of a sudden are a hot asset class again – try booking a room at a resort. Your eyes will pop out at the room rates. Some seem to be up over 100% since a couple of years ago.

But for office, I suspect that now is the moment of maximum over-pessimism, so that bargains might just be abounding.

I know if I personally were going into the real estate world as a real estate player, I would be looking around the office wreckage trying to be – my favorite phrase – overpaid for risk.

So I am sending this out right before Labor Day since I think that might be the magic moment when the trends reverse, and offices start to repopulate in a big way once more.

PS, I am disclosing that I personally hold stock in SL Green.

Bruce Stachenfeld aka The Real Estate Philosopher®